As a business owner, it is important to be aware of the risks associated with fraudulent activities and take steps to protect your company. Fraud can take many forms, from phishing scams to check fraud and cyber-attacks. In this blog, we'll provide fraud prevention tips and effective strategies to help keep your business safe.

Park View Business Fraud Prevention Solutions

When working with Park View, you’re not only working with experienced Member Business and Loan Advisors to help guide your business, but also have access to the latest digital banking solutions to keep your account and transactions protected. Park View offers a variety of tools you can utilize to help safeguard your business.

- Monitoring your accounts regularly is crucial for detecting any fraudulent activity promptly. By using online banking and the Park View mobile app, you can easily monitor your account activity from anywhere, at any time. This allows you to stay informed and quickly identify any unauthorized transactions or unusual account behavior.

- Activating online banking alerts adds an extra layer of security to your accounts. By receiving instant alerts via email and text message, you can stay updated on important account activities such as balance thresholds, processed payments, transfers, and more. These alerts allow you to quickly spot any unusual activity and take immediate action to protect your accounts. Park View Business credit cards holders should register on myaccountaccess.com to receive account alerts, security alerts, and fraud notifications

- Reviewing your electronic statements as soon as Park View notifies you that your eStatements are ready for viewing allows you to verify all transactions and ensure that they are legitimate. This helps you detect any unauthorized activity early and take appropriate measures to address it.

- Knowing who to contact in the case of suspected fraud ensures that you can report any fraudulent activity quickly and efficiently, minimizing any potential financial losses. For debit card fraud, you can contact Park View at (888) 918-7313 and for credit card call (800) 558-3424. If you suspect business account fraud, should contact a Member Business Advisor at (540) 236-5761.

Internal Procedures and Controls

Implementing proper internal procedures and controls within your business gives you peace of mind knowing you are mitigating the risk of fraudulent attacks and strengthening your overall defense. Once you have established internal controls, it is important to ensure they are followed consistently. This includes:

- Regularly reviewing bank accounts to detect any irregularities or unauthorized transactions should be part of your daily routine. Monitoring your accounts daily allows you to identify fraudulent transactions much faster and increases your likelihood of recovery.

- Implementing payment control procedures such as dual control procedures or a secondary communication channel to validate payment-related requests can help monitor and provide early detection of suspicious activity. Prevent payment-related fraud by requiring two separate people to authorize or initiate ACH payments, remote deposits, wires, tax payments, and check automation, as well as payment requests from customers and vendors, and vendor requests for changes in payment.

- Implementing a clear separation of duties and access for employees ensures that no single individual has complete control over a critical process. By limiting financial data access only to employees with a business need, following the need-to-know principle, and separating account receivable and accounts payable functions and processes you can effectively verify transactions, detect errors, and pinpoint irregularities.

- Regularly conducting random audits and testing is essential to identify control weaknesses, irregularities, or fraudulent activities that may otherwise go unnoticed. This includes regularly reviewing employee financial access privileges and processes to restrict access to authorized personnel only.

- Educating employees on recognizing fraud attempts, including phishing emails and social engineered phone calls should be part of your fraud prevention strategy. Employees can be your first line of defense, so encourage them to recognize the key role they play in preventing fraud losses and ensure they follow established policies and procedures, including reporting any unusual activity or requests they receive, even if they seem legitimate.

Internet and Technology Safety

In today's digital age, modern technology has revolutionized the way businesses operate, enabling faster and more efficient transactions. However, this technological advancement has also created greater opportunities for cybercrime. Therefore, being vigilant and safeguarding your computer systems is vital in preventing fraud. By implementing online protection measures and controls, businesses can safeguard their financial assets from cyber threats.

- Protect workstations by regularly updating the operating system, software, and antivirus programs. Fraudsters often target vulnerabilities within software to gain access to systems or steal information. Consider using security software and a firewall for added protection while patching and updating systems regularly.

- Protect your data by using strong passwords and implementing multi-factor authentication whenever possible to secure your accounts. Set strong passwords that do not include personal information and remember to change passwords frequently. It's important to avoid sharing or reusing passwords to prevent unauthorized access. Remember, verification codes, PINs, or answers to security questions should never be shared. Additionally, lock your computer when it is not in use to further safeguard your information.

Preventing Paper Check Fraud

According to a study conducted in 2022, 40% of all Business to Business payments are made with paper checks which means that ensuring the security of paper checks is essential for protecting your business against fraudulent activities. By implementing a few procedures, you can minimize the risk of unauthorized payments and protect your business from costly and time-consuming check fraud.

- Creating guidelines on approving checks before they are written can prevent unauthorized payments. Require high dollar checks to be pre-authorized and limit the number of employees with the ability to sign checks. Consider using Automated Clearing House (ACH) when possible, to securely and electronically deposit funds to financial institutions.

- Ensure check security by selecting a highly established, qualified check vendor and reviewing your check stock controls. Use a different style of checks for each account for easy recognition and select designs with incorporated security features such as watermarks, chemical resistance, or micro-printing. When writing checks, choose a black gel pen, as its ink is harder to tamper with, providing added security against alteration or fraud. Store canceled checks, blank checks, and bank account information securely with limited employee access in a secured area and limit the working supply of checks.

By understanding what to look for and implementing effective fraud prevention tips, you can better safeguard your business. From strengthening internal procedures to fostering a culture of vigilance and providing fraud education for your employees, there are numerous fraud prevention tips and strategies to enhance your business's security. Remember, when it comes to protecting your business's assets, Park View is here to assist you. Feel free to contact our Business Services team if you encounter any situations where you suspect fraudulent activity. For a complete checklist, please download our PDF guide here.

Share This

You May Also Like

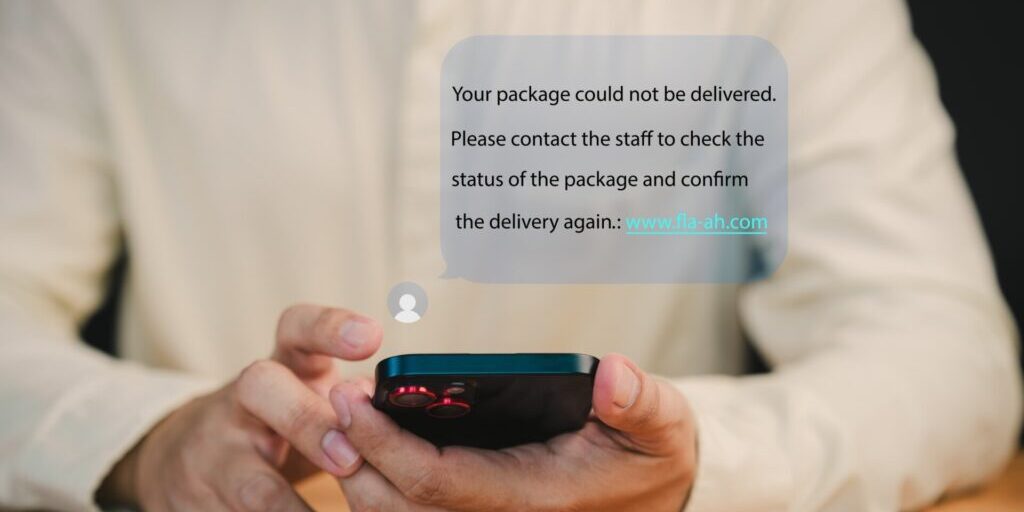

How to Spot and Avoid a Package Delivery Scam

Cybersecurity Month: Identifying Scams, Red Flags, and Safety Tips

Understanding Data Breaches: How to Protect Your Information and Respond Effectively

Want to learn more?

Discover additional resources and other financial topics by visiting our Financial Education Center.

Now Park View makes it even easier to schedule an appointment with one of our service representatives.

Now Park View makes it even easier to schedule an appointment with one of our service representatives.