Credit Score Solutions

Your Free Tool for Credit Scores, Reports, and Monitoring1

Powered by SavvyMoney®

Stay on top of your credit score with daily updates, full credit reports, and more in Online and Mobile Banking.

Improve Your Financial Well-Being with Credit Score

Park View members can enjoy access to their credit score, insights, and monitoring alerts directly in online and mobile banking. It’s free, easy, and won’t affect your credit score. Key features include:

Real-Time Credit Score

Log in to Online and Mobile Banking to get an updated credit score and stay informed.

Credit Report

View detailed information and accounts that shape your credit report and easily dispute inaccuracies.

Credit Score Simulator

Simulate different actions like a new loan or inquiry and see how they would impact your credit score.

Credit Alerts

Stay protected with real-time alerts about changes to your credit report, helping you detect unusual activity or potential fraud.

Getting Started

To get started you must be enrolled in online and mobile banking and enroll in Credit Score.

Once you have enrolled, the Credit Score Feature will always be available when you log in to Park View's online banking or the mobile app.

Login

Enroll or sign in to

Online and Mobile BankingNavigate

Locate Credit Score and

click Show My ScoreEnroll

Enter date of birth and accept terms and conditions to sign up and you're all set!

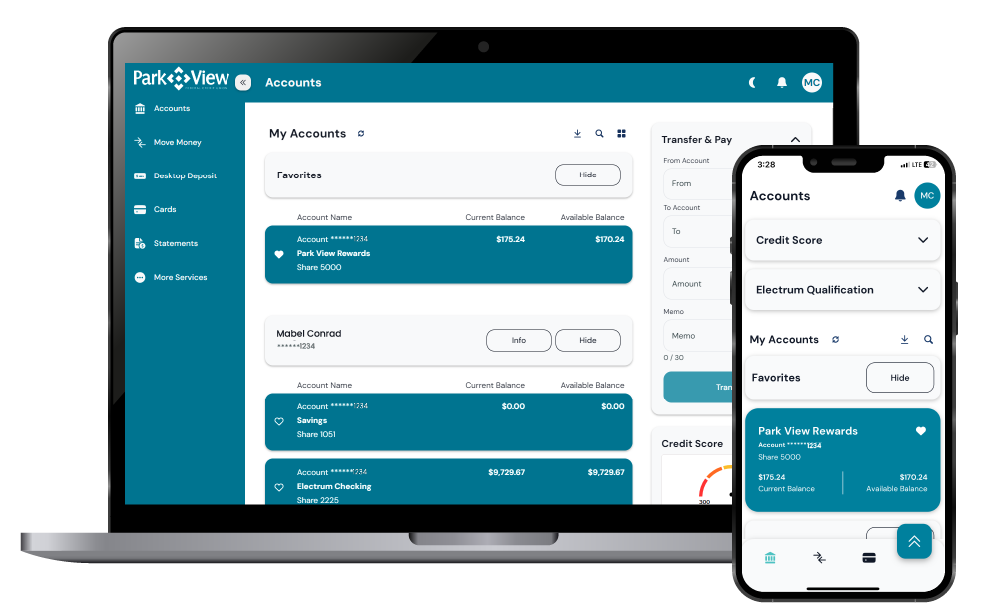

On Desktop

In online banking, click the Show My Score button in the right-hand column below the transfer money section. Enter your date of birth and accept the terms and conditions.

On Mobile

On the mobile app, click Credit Score located under your accounts on the 'Accounts' tab and click Show My Score. Enter your date of birth, accept the terms and conditions.

Credit Score FAQs

Get the answers you need to your questions about a the Credit Score feature in Online and Mobile Banking.

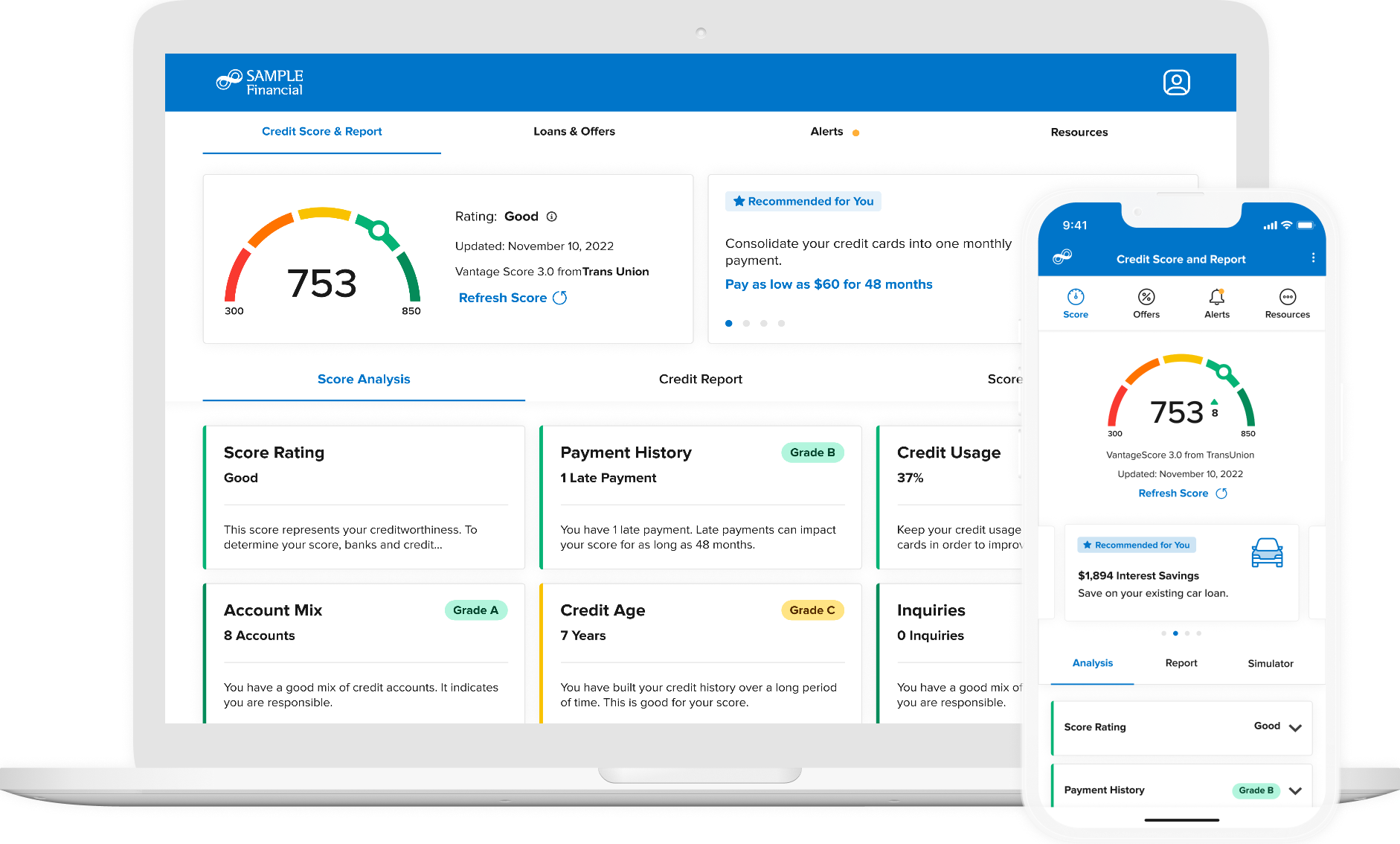

SavvyMoney is a comprehensive platform that provides users with free and ongoing access to their latest credit scores and reports, real-time credit monitoring, and savings opportunities on existing and new loans and credit cards – all through their online and mobile banking.

No. Credit Score is entirely free to the user, and no credit card information is required to register.

Every 7 days scores are updated and displayed in digital banking. Users can also refresh their score and full report every 24 hours by clicking “Refresh Score” and navigating to the detailed Credit Score Dashboard within digital banking.

Yes. Credit Score by SavvyMoney will monitor and send email alerts when there’s been a change to your credit profile.

Score Simulator is an interactive tool that allows users to see how hypothetical actions may affect their credit score, including things like paying off a credit card balance or applying for a loan. Just like checking their credit score through SavvyMoney, using the simulator does not affect the user's credit score.

SavvyMoney pulls users’ credit profiles from TransUnion, one of the three major credit reporting bureaus, and uses VantageScore 3.0, a credit scoring model developed collaboratively by the three major credit bureaus, to make score information more uniform between the different bureaus and provide consumers with a better picture of their credit health. Key factors that drive the score are the same.

Credit Score and More is a "soft inquiry" which does not affect a credit score. Lenders use "hard inquiries" to make decisions about creditworthiness when you apply for loans.

No, Park View uses their lending criteria when making final loan decisions.

The SavvyMoney Credit Score makes its best effort to show you the most relevant information from your credit report. If you think that some of the information is wrong or inaccurate, we encourage you to take advantage of obtaining free credit reports from www.annualcreditreport.com, and then pursuing with each bureau individually. Each bureau has its own process for correcting inaccurate information but every user can “File a Dispute” by clicking on the “Dispute” link within their SavvyMoney Credit Report. However, The Federal Trade Commission website offers step-by-step instructions on how to contact the bureaus and correct errors.

Yes, SavvyMoney Credit Score is available for both mobile and tablet devices and is integrated inside our mobile application.

Three major credit-reporting bureaus (Equifax, Experian, and Transunion) and two scoring models (FICO or VantageScore) determine credit scores. Financial institutions use different bureaus, as well as their own scoring models. Over 200 credit report factors may be considered when calculating a score, and each model may weigh credit factors differently, so no scoring model is identical.

Download the Park View App

It’s like your credit union’s right there with you, wherever you go.

New to online banking? Enroll in your account now.

Online and Mobile Banking

Conveniently check your balances, make a transfer, pay bills, access your statements and more.

Now Park View makes it even easier to schedule an appointment with one of our service representatives.

Now Park View makes it even easier to schedule an appointment with one of our service representatives.