Extended Deposit Insurance

Protect up to $5 Million with NCUA Insurance

Extended Deposit Insurance Account

Protect your business funds with extended NCUA insurance coverage through our trusted partner network, all conveniently managed in one account.

$5 M protection available

Extended NCUA federal insurance through our network of partner credit unions.

Zero monthly service fees

No minimum balance fees or monthly maintenance fees.

Full control of funds

Deposit, transfer, and withdraw money at any time, just like a regular transaction account.

Account Details

Included with Your Extended Insurance Account:

Single Banking Relationship

Enjoy extended NCUA share insurance without the hassle of multiple accounts.

Earn Dividends

Grow your account with interest earned on your entire balance.

How Extended Deposit Insurance Works

-

Deposit Your Funds

Deposit up to $5 million directly with Park View. There’s no need to open additional accounts elsewhere.

-

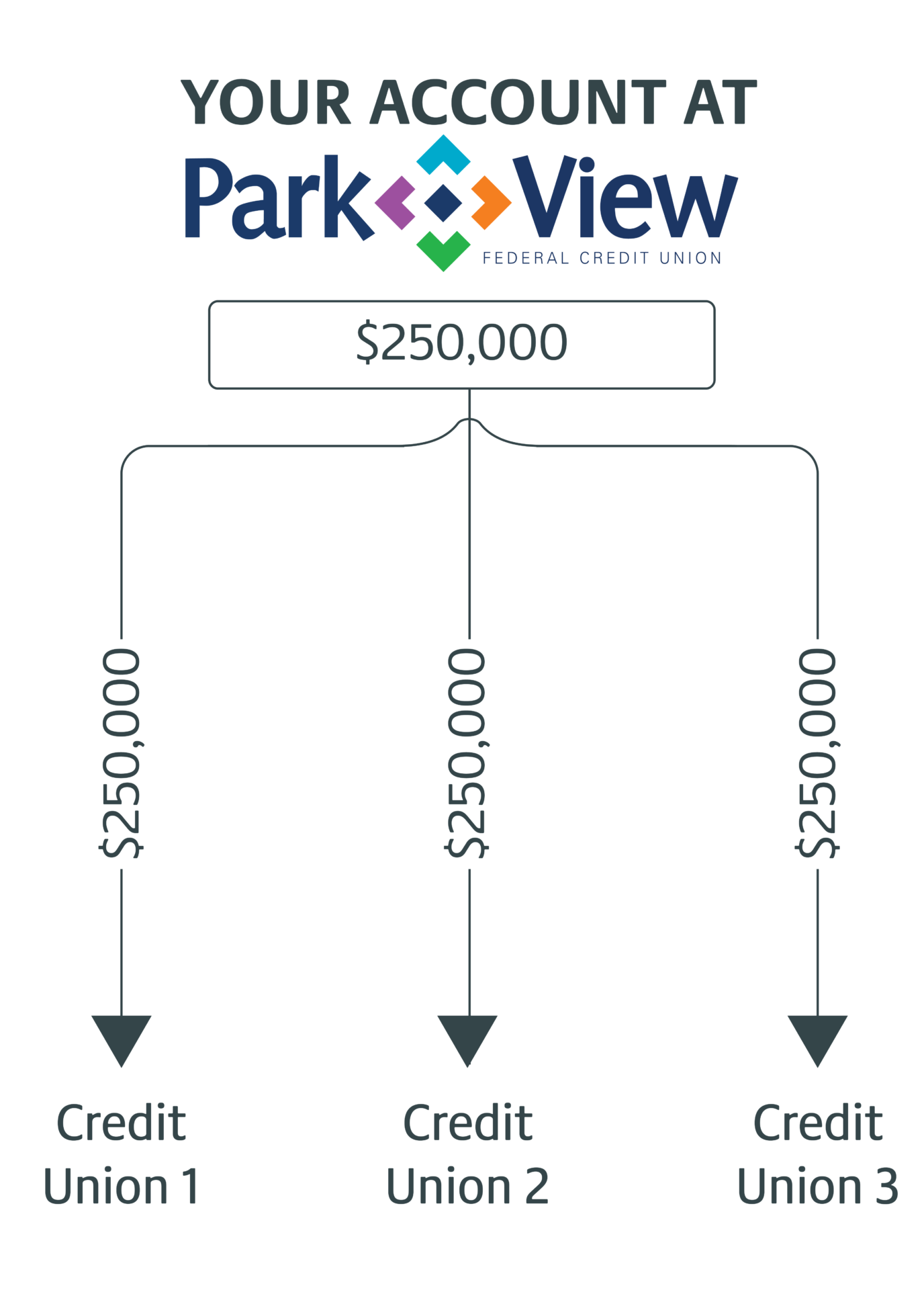

Automatic Allocation

Once the deposit is funded, Park View securely divides the funds into smaller portions and places them in demand deposit accounts at various participating credit unions within the ModernFi Network.

- For example:

- $250,000 at Park View FCU

- $250,000 to Credit Union 1

- $250,000 to Credit Union 2

- $250,000 to Credit Union 3

- For example:

-

NCUA-Backed Coverage

Each participating credit union ensures your deposits are fully insured by the NCUA, up to $250,000 per share owner per credit union. This provides comprehensive protection for the entire $5 Million.

-

Seamless Management

All transactions, deposits, and withdrawals are managed through your Park View account as usual. The extended protection is handled automatically in the background.

How to Get Started

Open an Extended Insurance Account

Contact Us

Schedule an appointment with a Member Business Advisor.

Fund Account

You can open an Extended Insurance account with $0.

Enjoy Peace of Mind

Comfort of knowing your funds are federally insured.

Questions About Extended Deposit Insurance

Get the answers you need to your questions about Extended Deposit Insurance at Park View.

To fund the account, members can transfer funds from their established accounts to their newly opened Extended Deposit Insurance Account. Those funds will then be moved into the deposit network by your credit union's operations team, where they can be withdrawn upon request.

The NCUA insures deposits up to $250,000 per share owner per credit union. Deposit networks automate distributing funds to multiple NCUA-insured institutions, keeping balances under the limit to ensure full coverage. Deposits remain protected by the NCUA and backed by the U.S. government through the NCUSIF. While ModernFi is not an NCUA member, all partner credit unions are.

Extended Deposit Insurance Accounts offer robust security, safeguarding funds up to $250,000 per member at each participating credit union through NCUA insurance. Since 1970, no member has lost NCUA-insured funds due to a credit union failure.

In the rare event of a failure, the NCUA settles deposit claims, and funds are typically disbursed within a few business days. ModernFi ensures all necessary filings are completed for prompt payment.

Yes, you can easily view and manage your funds anytime and handle your banking directly through Park View. To make a withdrawal, simply transfer funds from your Extended Deposit Insurance Account to your business account using the ModernFi Member Portal. Funds are typically available the same day or by the next business day.

Take the first step to maximize your earnings!

Open an Extended Deposit Insurance Account by scheduling an appointment with a Business Member Advisor today.

Need more ways to save?

At Park View, we offer a variety of smart savings tools to fit your financial goals. Explore your options.

Disclosures

1Funds participating in Park View's Extended Deposit Insurance Account are deposited into accounts at participating credit unions, which are insured by the National Credit Union Association (NCUA) for up to $250,000 for each category of legal ownership, including any other balances you may hold directly or through other intermediaries, including broker-dealers. The total amount of NCUA insurance for your account depends on the number of credit unions in the program. If the balance in your account is greater than the NCUA insurance coverage in the program, any excess funds will not be insured. Please read the Program Terms and Conditions carefully before depositing money into the program and for other important member disclosures and information. To assure your NCUA coverage, please regularly review credit unions in which your funds have been deposited, and notify Park View immediately if you do not want to allocate funds to a particular credit union or credit unions.

Now Park View makes it even easier to schedule an appointment with one of our service representatives.

Now Park View makes it even easier to schedule an appointment with one of our service representatives.