Smishing Scams: How to Spot and Avoid Fraudulent Text Messages

Key Takeaways

-

Smishing, similar to phishing, is when scammers send a text to trick you into giving away personal information.

-

Avoid clicking links or responding to texts from unknown or suspicious sources.

-

If you receive a text, contact your financial institution or credit card company directly to confirm its legitimacy before sharing any information.

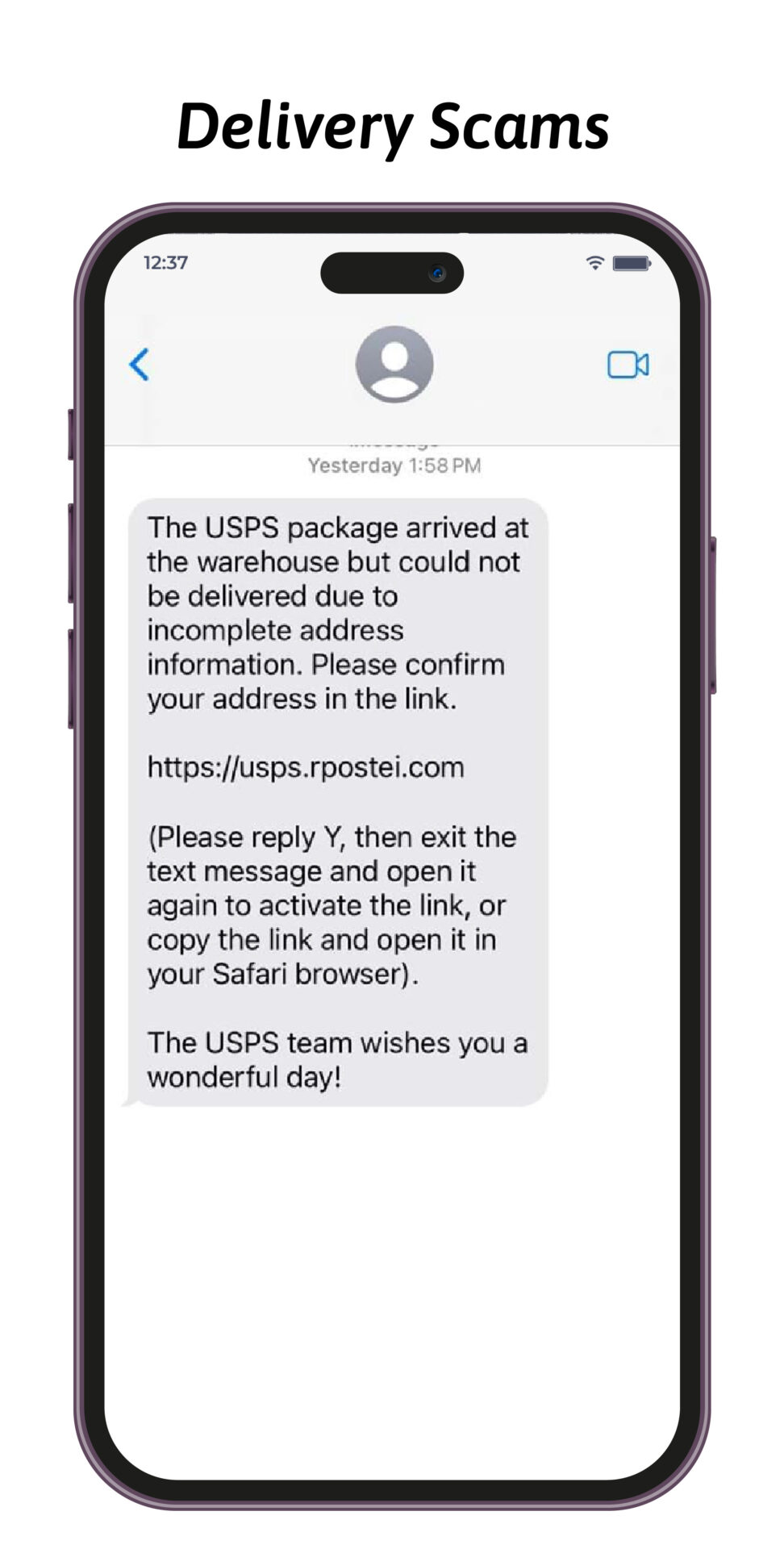

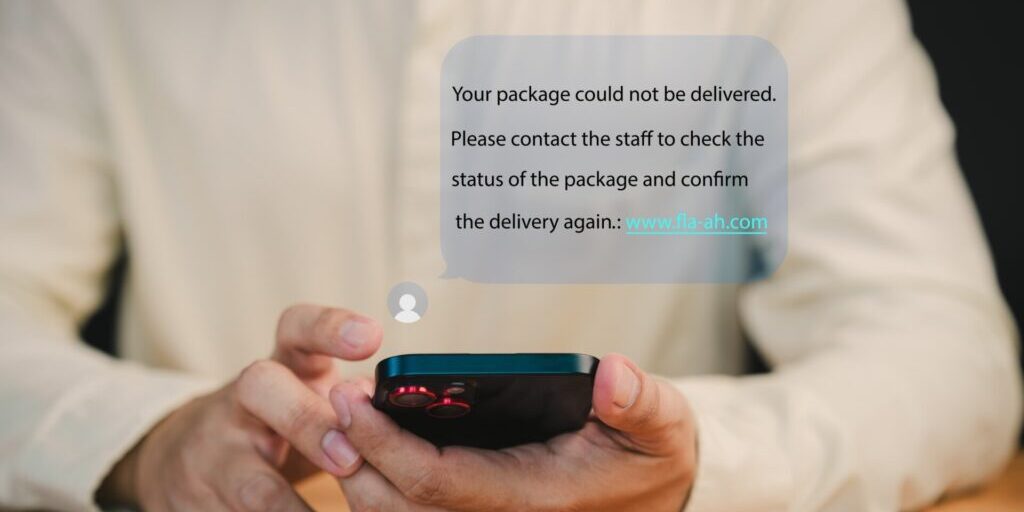

Your phone buzzes with a new text—supposedly from the U.S. Postal Service about your package. But is it real? Chances are, it’s a smishing scam.

Smishing scams are a growing threat in which scammers use text messages to impersonate reputable organizations such as banks, delivery services, and government agencies to steal personal information. Understanding how these scams work and how to protect yourself can help keep your personal and financial information safe. Let’s dive into the details of this scheme and what you can do to protect yourself from SMS phishing.

What is Smishing?

Smishing, a combination of “SMS” and “phishing,” is a text-message scam where fraudsters try to trick you into revealing personal information like passwords, account numbers, or your Social Security number. Once they get that information, they can access your email or bank accounts—or even sell your details to other scammers.

How do Smishing Scams Work?

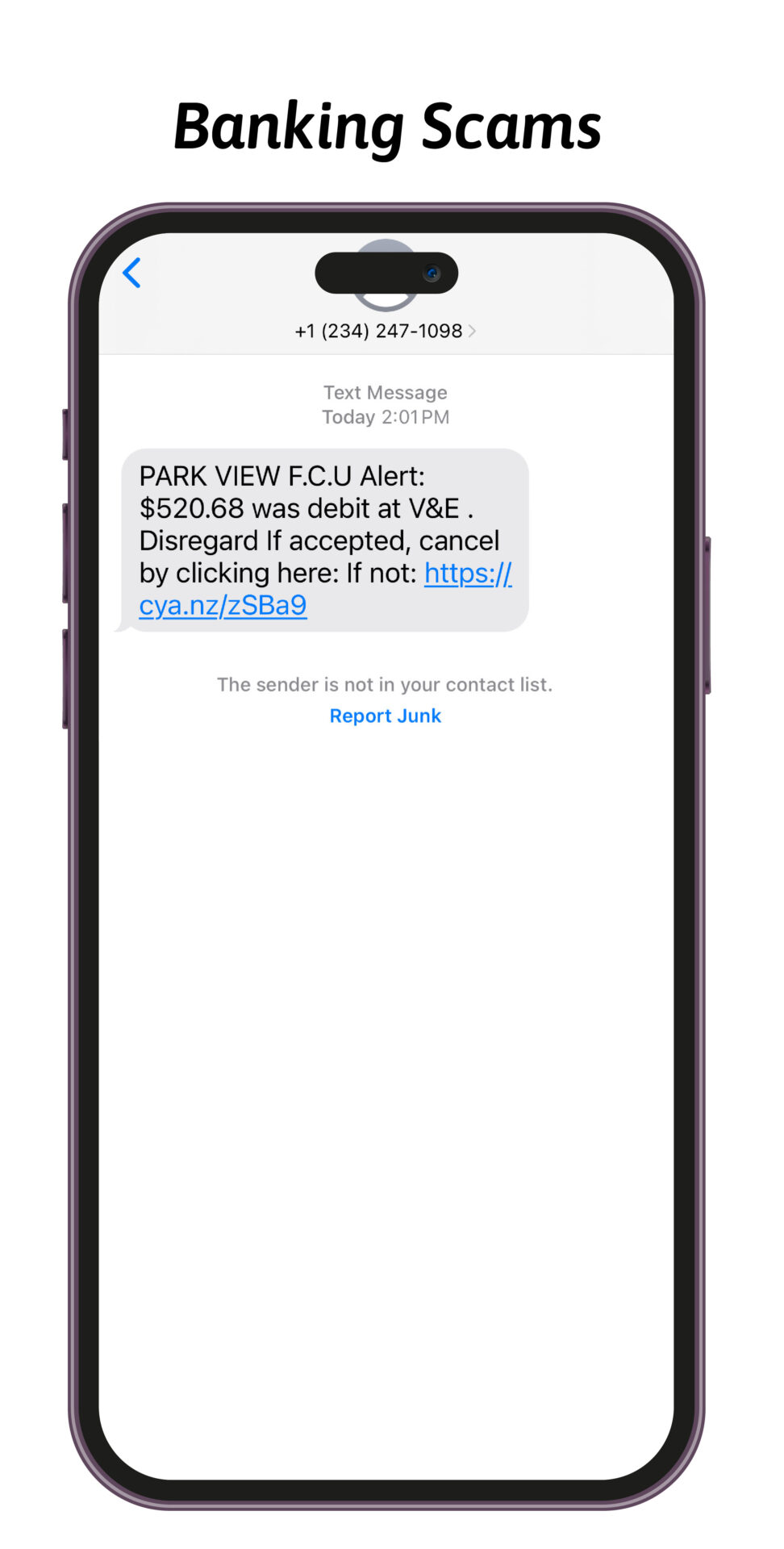

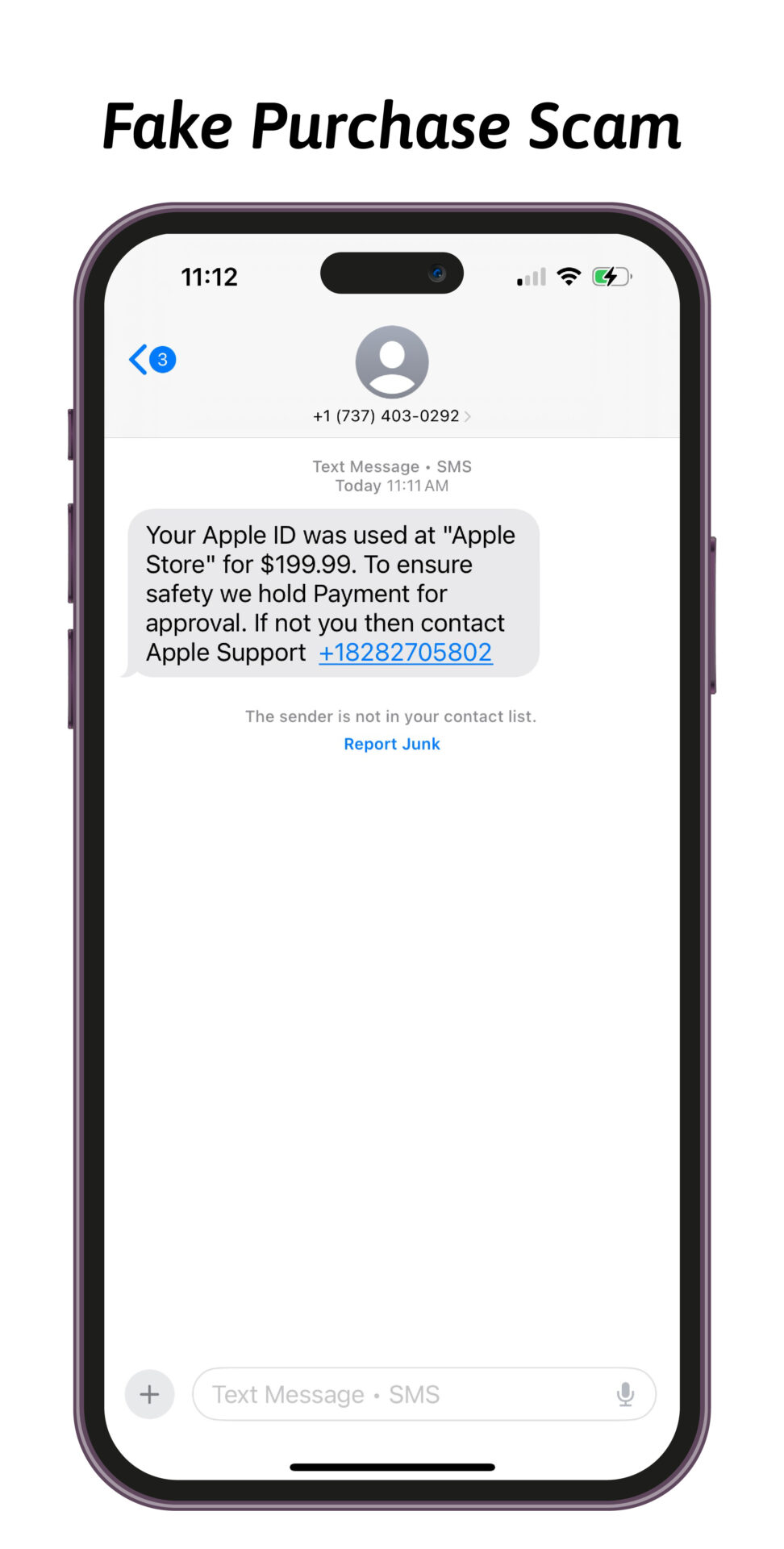

Scammers use different types of smishing scams to steal sensitive information. According to the Federal Trade Commission, some of the most common tactics include:

Recognizing Smishing Scams

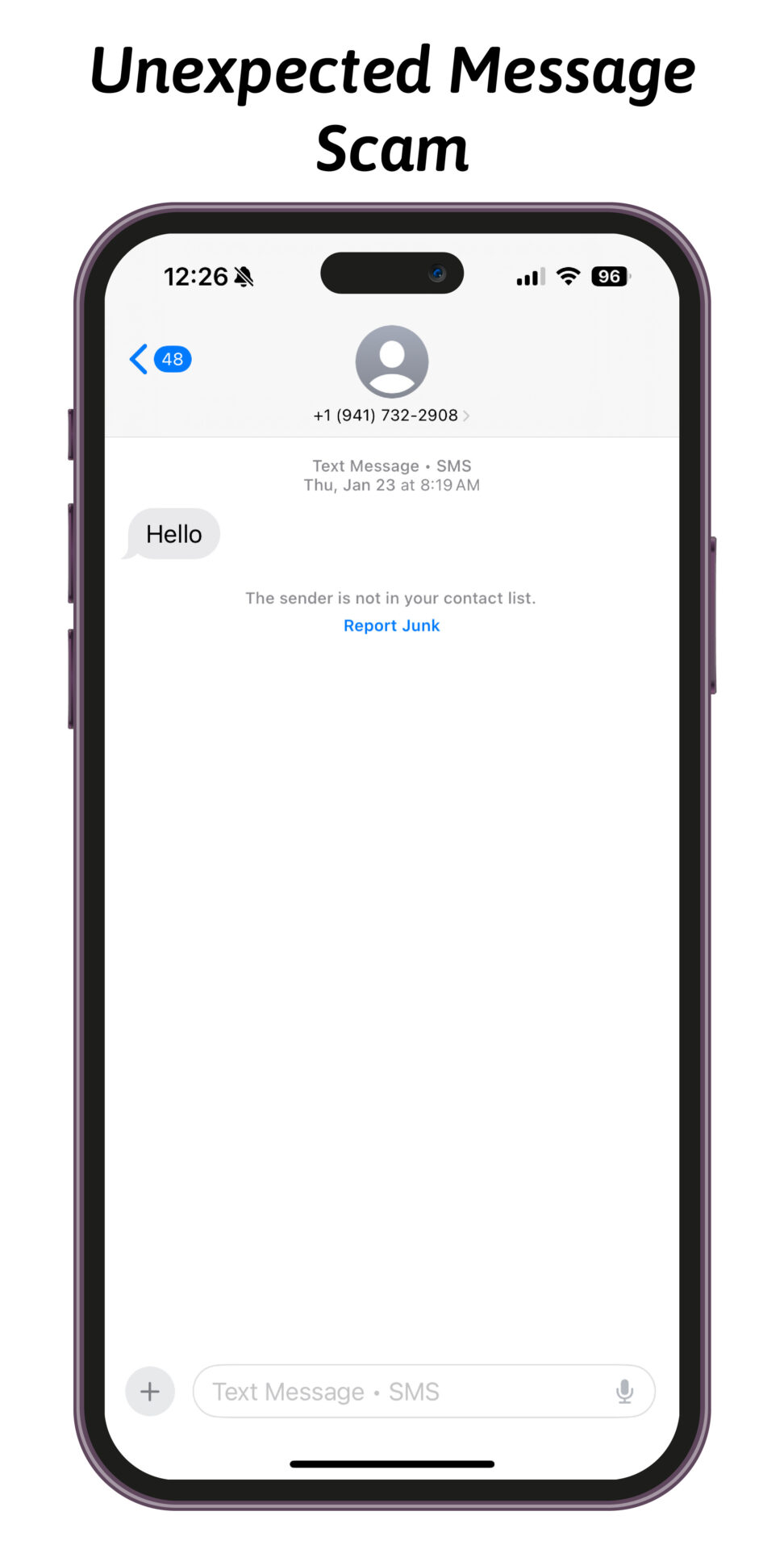

If you know what to look for, you’ll be able to spot a smishing scam at first glance. Here are some warning signs:

Park View will never call, text, email or message you asking for confidential information such as account numbers, usernames, multi-factor authentication codes, or passwords.

Our fraud department will send a text or call if debit card purchases are suspected as fraud, but we will NEVER include a link or ask for personal information. If you are unsure if a fraud alert is legitimate or not, pick up the phone and call us directly using the number on the back of your debit card.

How to Protect Yourself

With a little bit of caution, you can take steps to avoid becoming a victim of theft. If you’re unsure if a text is legitimate, follow these dos and don'ts.

DO

Do delete text messages that ask you to confirm or provide personal information: Legitimate companies don't ask for information like your account numbers or passwords by email or text.

Do look for red flags: Watch out for urgent language, typos, unfamiliar links, or unexpected messages.

Do contact the supposed text sender directly: If a text message claims to be from your financial institution or a company, contact them using their official website or phone number to confirm the message's legitimacy.

Do report suspicious messages: Forward scam texts to 7726 (SPAM) or report them to the FTC at reportfraud.ftc.gov.

Do enable Multifactor Authentication: Park View requires MFA for added security and enabling it on your other accounts can further protect your personal information.

DON'T

Don’t open links from unknown senders: These can lead to fake websites designed to steal your information.

Don’t share personal or financial details: Legitimate companies will never ask for sensitive info over text.

Don’t respond to scam texts: Like website links, text responses can be used to verify your phone number and gain access to your personal information. Even replying “Stop” can confirm your number is active and lead to more scams. Check with your financial institution to see if it offers SMS text banking or mobile alerts. That way you can identify the difference between a real message and a fake.

Don’t trust messages that seem too good to be true: If you didn’t enter a contest, you didn’t win a prize.

Don’t download unknown attachments: They may contain malware designed to steal your data.

I opened the link. Now what?

If you clicked on a suspicious link, don’t panic—but act quickly. Follow these steps to protect your information and secure your account.

Don't Enter Any Personal Information

If you clicked on a suspicious link, don’t panic—but act quickly. Follow these steps to protect your information and secure your account.

Report the Incident to Park View

Reach out to us directly at 540.434.6444 to report the phishing attempt. Lock your debit card in Online Banking or the Park View app. We'll help ensure your account is secure and assist with any necessary actions.

Change Your Account Password

If you entered any login credentials or sensitive information, update your account password as a precaution. Avoid using the same password across multiple accounts.

Monitor Your Accounts

Regularly check your Park View account for any unauthorized transactions or changes. Consider setting up text message and email account alerts in online and mobile banking and contact us immediately if you notice anything suspicious.

Scan Your Device

Finally, have your device checked to ensure no malware has been installed on your device. If you notice your phone is slower than usual or there are new apps you don't remember downloading, that's a potential sign that your device has a virus.

Smishing scams are becoming more common, but by staying informed and cautious, you can protect yourself. If a text message seems suspicious, don’t engage—delete it, report it, and verify directly with the company.

At Park View, we prioritize your security. If you ever receive a questionable message claiming to be from us, call us directly at 540.434.6444. Together, we can fight fraud and keep your accounts secure.

Share This

You May Also Like

How to Spot and Avoid a Package Delivery Scam

Cybersecurity Month: Identifying Scams, Red Flags, and Safety Tips

Understanding Data Breaches: How to Protect Your Information and Respond Effectively

Want to learn more?

Discover additional resources and other financial topics by visiting our Financial Education Center.

Now Park View makes it even easier to schedule an appointment with one of our service representatives.

Now Park View makes it even easier to schedule an appointment with one of our service representatives.