Wire Transfers

Wire Transfers

Send money across town or across the world

Easily send or receive funds with Park View’s wire transfer services. Whether you need to transfer money within the U.S. or internationally, we’ve got you covered with secure and reliable solutions.

Wire Transfer Scams

Before wiring any money, always confirm the recipient's information and identity. You want to triple-check that your money will be sent to a legitimate person or organization, and not a scammer impersonating them. If you can't confirm the recipient's identity in person, call them using a number you verified independently.

Wire Transfer Instructions

Sending a Wire Transfer at Park View

Safely and securely send funds domestically or internationally with our outgoing wire transfer service. Please note that fees apply for sending wires.

Sending a Domestic Wire

Send money anywhere within the U.S. and its territories. To initiate a domestic wire, you’ll need the following:

Payee Information:

Transfer Information:

Receiving Financial Institution Information:

Sending an International Wire

Wire funds overseas in either U.S. or foreign currency. Please contact the payee for their financial institution’s wiring instructions to ensure timely delivery.

Here’s what you’ll need for an international wire transfer:

Payee Information:

Transfer Information:

Receiving Financial Institution Information:

Receiving a Wire Transfer at Park View

Park View members can receive funds to their credit union account through both domestic and international wire transfers.

Receiving a Wire in US Dollars (USD)

To receive funds in US Dollars, provide the following information to the sender:

Financial Institution Name: Park View Federal Credit Union

City, State: Harrisonburg, Virginia

Routing/ABA Number: 251480806

Member Information:

- Name (as it appears on the account)

- Account Number

- Mailing Address

Receiving a Foreign Currency Wire

To receive funds in another currency, provide the following details to the sender:

SWIFT Code: BOFAUS3N

Beneficiary Bank:

Bank of America, 901 Main St, Dallas, TX 75202 USABeneficiary Name: Park View Federal Credit Union

Beneficiary Address:

C/O AscendantFX, 5000 Marketplace Way, Enola, PA 17025Beneficiary Account: 4451932448

Further Credit To:

- Member Name

- Member Account

Click here to view the full list of currencies accepted at Park View Federal Credit Union.

Wire Transfer Fees

| Wire Type | Cost |

|---|---|

| Outgoing Domestic (initiated in Online Banking) | 10 |

| Outgoing Domestic | 15 |

| Outgoing Foreign (in foreign currency) | 25 |

| Outgoing Foreign (in US currency) | 40 |

| Incoming Foreign Wire | 15 |

| Incorrect/Incomplete Wire Information | 25 |

| Wire trace/return | 75 |

Questions About Wire Transfers?

Get the answers you need to your questions about Wire Transfers at Park View.

You can initiate a wire transfer by visiting a branch, contacting us by phone or email, or using our online and mobile banking platform. For domestic transfers, you’ll need the recipient’s name, address, account number, and the receiving bank’s routing number. For international wires, you’ll also need the recipient’s SWIFT code and IBAN (if applicable).

Park View members can receive both domestic and international wire transfers. For domestic wires, provide the sender with your name, account number, and Park View’s routing number (251480806). For international wires, in addition to this information, you’ll need to provide Park View’s SWIFT code and full address.

Yes, you can initiate wire transfers through Park View's online and mobile banking. You can wire funds on the same day or schedule them for a future date, whether you're sending money to your own account or someone else’s at another financial institution.

To create a wire transfer, go to Move Money > Wire Transfer

Please note there are limitations:

- Only Domestic Wires can be completed in online and mobile banking

- $10,000 daily limit

- Wires cannot be reused, but past wire details can be referenced using the search feature.

Fees apply for outgoing wire transfers, both domestic and international. Incoming wires are free unless sent via the SWIFT Network, in which case a processing fee applies. Please refer to our fee schedule for specific costs.

Yes, Park View supports international wire transfers in U.S. dollars or foreign currency. You’ll need the recipient’s account details, the receiving bank’s SWIFT/BIC code, and the currency type for the transfer.

Domestic wires are usually processed the same business day, with funds often available the next business day. International wires may take longer depending on the recipient’s bank and country.

A wire transfer is a fast and secure way to send money directly between financial institutions, with funds typically received the next business day. Wire transfers are ideal for large, one-time transactions, and they can be sent both domestically and internationally. Fees depend on the type of wire transfer.

An ACH (Automated Clearing House) transfer is similar to wire transfers, but are are generally slower, taking 1-3 business days. ACH transfers are often used for recurring payments like payroll or bill payments. ACH transfers are typically less expensive or free, but they are usually limited to domestic transactions and have lower daily limits.

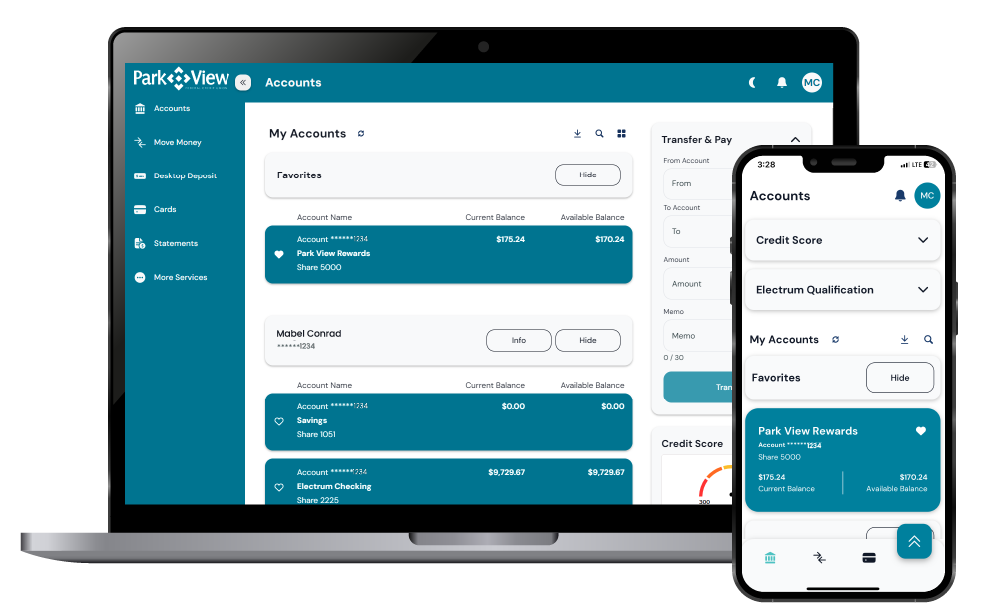

Online and Mobile Banking

Conveniently check your balances, make a transfer, pay bills, access your statements and more.

Now Park View makes it even easier to schedule an appointment with one of our service representatives.

Now Park View makes it even easier to schedule an appointment with one of our service representatives.